Investment Strategies

Asset Allocation

Risk Assessment

Evaluate your risk tolerance and investment horizon to determine an appropriate mix of conservative and growth-oriented investments. Align your portfolio with your risk profile to maintain stability while maximizing growth potential.

Long-Term Focus

Adopt a long-term investment perspective and avoid making impulsive decisions based on short-term market fluctuations. Stay focused on your financial goals and investment plan through market ups and downs.

Regular Rebalancing

Periodically rebalance your investment portfolio to realign with your target asset allocation. Rebalancing helps control risk exposure and ensures that your portfolio remains diversified and optimized for growth potential.

Cost Efficiency

Minimize investment costs by choosing low-cost investment vehicles such as index funds or exchange-traded funds (ETFs) over actively managed funds. Lower expenses can significantly impact investment returns over time, enhancing growth potential.

Tax Efficiency

Implement tax-efficient investment strategies such as utilizing tax-advantaged accounts like IRAs or 401(k)s and employing tax-loss harvesting techniques to optimize after-tax returns. Efficient tax planning preserves more of your investment gains, contributing to financial stability.

Research and Due Diligence

Conduct thorough research and due diligence before making investment decisions. Evaluate potential investments based on factors such as historical performance, underlying fundamentals, and risk characteristics to mitigate downside risks and enhance growth potential.

Dollar-Cost Averaging

Implement a dollar-cost averaging strategy by regularly investing a fixed amount of money regardless of market conditions. This approach helps smooth out market volatility and allows you to buy more shares when prices are low, potentially increasing growth potential over time.

Emergency Fund Provision

Maintain a separate emergency fund in liquid assets like cash or short-term bonds to cover unexpected expenses or income disruptions. Having a financial safety net ensures stability and prevents the need to liquidate investments prematurely during emergencies.

Continuous Monitoring and Adjustment

Monitor your investment portfolio regularly and make adjustments as needed based on changes in your financial situation, market conditions, or investment objectives. Stay proactive in managing your investments to adapt to evolving circumstances and optimize growth potential while maintaining stability.

Embracing a Long-Term Investment Strategy: The Key to Financial Success

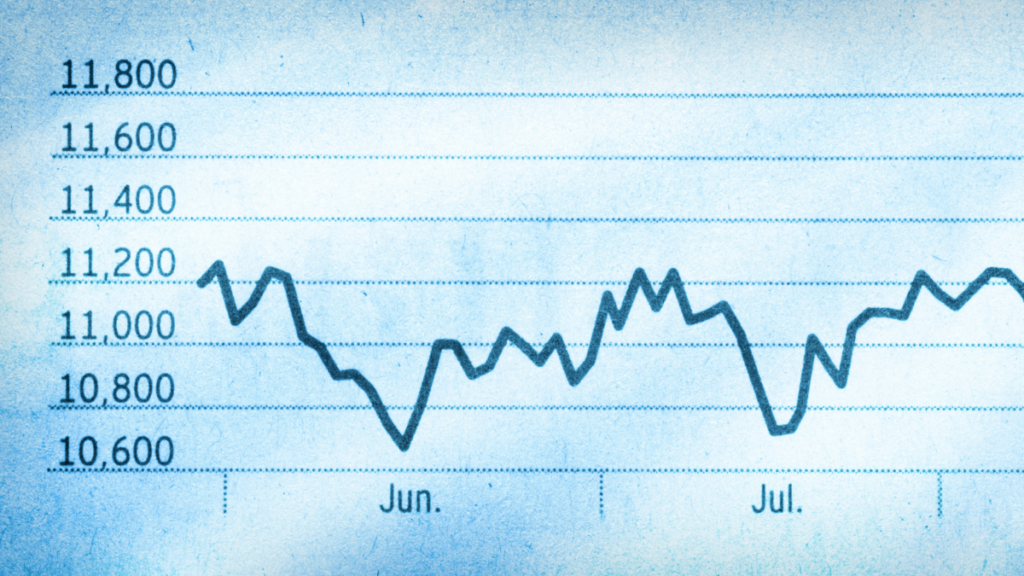

In the world of investing, it can be easy to get caught up in the market's daily fluctuations. Stock prices rise and fall, headlines scream about market corrections or booms, and emotions can run high.

Dollar-Cost Averaging: A Smart Investment Strategy

Investing in the stock market can be daunting, especially for beginners. The fear of market volatility and the risk of significant losses can deter many from taking the plunge.